Vinovest

Strengths

- $300 minimum investment for whiskey, $1,000 minimum investment for wine

- Wine futures opportunities

- Ownership of wine and whiskey, not "shares"

- Secure insured climate-controlled storage

- You can take possession of the wine or sell at any time. (you have to let whiskey mature before you can bottle it)

Weaknesses

- 2.5% annual fee (1.9% on $50+ investments)

- Selling wine can take some time (4 weeks)

- Can't sell whiskey for 2-5 years after purchase

When you think about investing, what comes to mind?

The stock market. Bonds. Precious metals. Real estate. Mutual funds. The usual stuff.

If I asked you for “interesting” investments, you’d probably say something like art, cryptocurrency, your friend’s business, a farm, etc.

Very few people would say they “invest” in wine or spirits. I have friends of means who love wine and when they buy expensive bottles of wine and whiskey, they never think of them as investments. They’re for drinking at some later time.

But wine and whiskey, like art, has a pretty solid track record when it comes to returns, and it’s attractive because it does not correlate with the stock market. The things that impact the price of a bottle of wine or spirits have nothing to do with what impacts the stock market. For example, the weather has a bigger impact on the price of a bottle of wine than the earnings of the winery that makes it (obviously). Consumer tastes have a bigger impact… which can be affected by the same things that impact the stock market, but it’s a weak relationship.

But there’s a huge barrier to entry to investing in wine or whiskey yourself. You have to commit a lot of money if you want to buy investable wines or whiskey casks yourself because you have to buy, store, climate control, protect them, etc. It’s difficult to do on your own.

But just like how AcreTrader has made it easy to invest in farmland, there’s now a company that will help you invest in wine and whiskey.

They’re called Vinovest.

Table of Contents

Who is Vinovest?

Vinovest was founded by Anthony Zhang and Brent Akamine, serial tech entrepreneurs who have started and sold several companies before Vinovest. Fun story – Zhang was an undergrad at USC when he pitched Mark Cuban and Mark Burnett when they spoke at USC (watch his pitch, remember this is over five years when he was still in college). He would eventually secure a $100,000 investment for a 5% stake in that company, EnvoyNow. EnvoyNow was an on-demand food delivery startup for colleges and was acquired by JoyRun in 2017.

Brent Akamine has a background as a designer having led design at Blockfolio, Bytedance (parent company of TikTok), and others. There’s less about him online but he also studied at USC.

What stands out is that the two co-founders don’t have a background in wine and spirits – fortunately, they’ve assembled a team with a wealth of it.

Here are just a few of the advisors:

- Jane Lopes is a sommelier who has had experience at Eleven Madison Park in NYC, The Catbird Seat in Nashville, The Violet Hour in Chicago, as well as Attica in Melbourne. She is a Master Sommelier (only one of fewer than 30 women to achieve this).

- Dustin Wilson is a Master Sommelier and was Wine Director at Eleven Madison Park.

- Jonathan Ross was a head sommelier at Eleven Madison Park and beverage director for the Rockpool Dining Group in Melbourne. He also curated wines for Qantas Airlines and launched his own wine label, Micro Wines.

- DLynn Proctor is a winery executive with roles at Penfolds Winery and Fantesca Estate & Winery.

- Yannick Benjamin is the head sommelier at the University Club and an Advanced Sommelier with the Court of Master Commeliers

It’s a pretty impressive list of wine experts, which is what you’d like to see in a platform that helps you invest in wine.

How Does Vinovest Work?

Vinovest is pretty straightforward – you decide if you want to invest in wine or whiskey (or both), answer a few questions in an onboarding quiz, and fund your account. Depending on your answers and the size of your deposit, wine and whiskey are then automatically added to your portfolio.

It’s pretty easy to open an account, and you can do so with just $300 for whiskey and $1,000 for wine. If you want to invest in particular wines or whiskeys (or have any other questions), you can book a free consultation with one of Vinovest’s advisors before depositing. They estimate that a $5,000 portfolio would hold about 24 to 36 individual bottles, which prices them out to be $208 to $139 each.

When you buy the wine and whiskey, Vinovest will store them securely for you at their insured facility. They charge a 2.5% annual fee that is lowered to 1.9% when your portfolio value exceeds $50,000. This fee is higher than you’d expect for many other alternative investments, but they need to store your wine and whiskey in a climate-controlled, insured location. You don’t have these concerns if you invest in an index fund, farmland, or something else.

If you want to take possession of any of your wine or whiskey, you can. They’ll ship wine to you at any time, and you can opt into bottling your whiskey once it matures.

Why Should You Use Vinovest?

You could buy wine bottles or whiskey casks yourself but Vinovest offers a few advantages:

Expertise: They have advisors who are Master Sommeliers and whiskey experts who have worked in the restaurant, winery, and distillery business. They select investable bottles and casks based on what they know of the industry, not their personal preferences or biases. They’re used to treating it like a business and not a delicious consumable good.

Storage & security: There’s value in storing wine and whiskey at their facility (in reality, they use global storage providers that currently store over $20 billion in wine) because it will be built to protect the wine and whiskey. What is the ideal relative humidity for storing wine? 60%. Do you have a way to store it at the ideal temperature and humidity? You could buy a way to store wine, but are you willing to make this investment?

And whiskey comes in 53-gallon casks, which are massive. Storing those would take an entire warehouse.

Insurance: Vinovest also insures the bottles and casks in their facility. Collectible insurance isn’t cheap and might be worth it if you invested a hundred thousand dollars in wine or whiskey, but not if you only invest a few hundred dollars. 🙂

Economies of scale: Since Vinovest is buying a lot of bottles, they likely get savings over what you’d get buying from a retailer. Another positive is that they sometimes will store the wine in the location they buy it, avoiding VAT (value-added tax).

En Primeur opportunities: “En Primeur” is when you buy wine that is still in the barrel – wine futures in essence – and it’s only available to industry insiders. It’s a limited part of their offering, but it’s still worth mentioning!

You can do all of this yourself – and many people do. But if I wanted to invest in wine or whiskey, I couldn’t because I lack the expertise and storage (and self-control not to drink the wine if it’s that good).

Vinovest Alternatives

Vinovest isn’t the only investment platform that specializes in wine and spirits. Another company that offers a similar service is known as Vint. Rather than individual bottles, Vint allows you the chance to buy shares in collections. These collections are generally valued in the tens to hundreds of thousands of dollars in value and it’s broken up into shares worth $100 each.

You Could Invest in Wineries

Let’s say you’re bullish on wine but don’t want to buy individual bottles – you can buy publicly traded companies that are in the wine business. People who are bullish on gold will buy companies that mine the stuff, rather than gold bullion itself. If you are bullish on oil, you could buy shares in drillers, refiners, pipelines, etc.

But this is like investing in business of wine, rather than the wine itself. For that, you could buy shares in companies like Constellation Brands (STZ). They own some iconic wine labels that you probably have in your wine rack.

Constellation Brands owns Kim Crawford (my wife loves their Sauvignon Blanc as her daily porch pounder… though she doesn’t drink it daily and we don’t have a porch), Robert Mondavi, Ravage, Nobilo, and more.

The tricky part is that those companies are also very big. Constellation also owns Corona, Modelo, Svedka Vodka, High West Whiskey, etc.

You get the idea – you’re buying a business and not just wine. Also, I don’t know if I’d buy bottles of Kim Crawford Sauvignon Blanc as an investment. 🙂

Should You Invest in Wine?

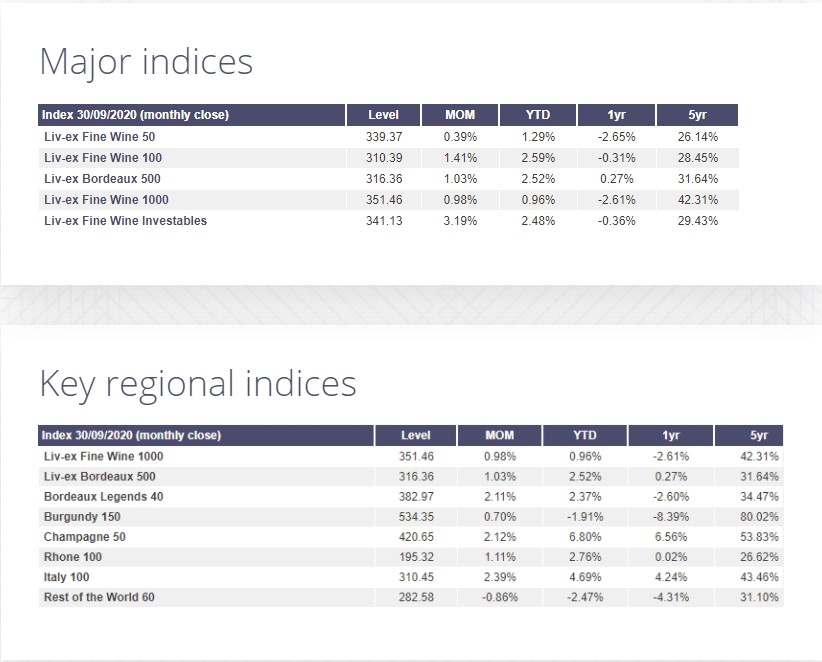

Did you know there have been wine price indices for a while?

For example, the Liv-ex 100 Fine Wine Index (LIVX100) was created in the fall of 2003 and they backdated it to 1988 – showing impressive returns for wines. Liv-ex stands for the London International Vintners Exchange. The LIVX100 is limiting though, they only include Bordeaux, but is still valuable to see:

Vinovest also has an index, the Vinovest 100 Index, which includes wine prices from a variety of regions including Bordeaux, Burgundy, Champagne, Rhone, Tuscany, etc. I find that these numbers less important for the numbers themselves but what they represent – Vinovest is very much on top of wine investing trends and knowledge. They produce a quarterly report that shows their expertise and can help grow yours. I recommend reading them.

Whether investing in wine is a good idea is really up to you.

As an investment, it offers returns and is not as volatile on a daily basis because prices don’t change that quickly. There isn’t an exchange where people buy and sell bottles every minute, like there is with the stock market. Much like investing in real estate, there can be large swings but the pace is never that frenetic – which is a nice change.

Like many other alternative investments, I think it offers a change from the stock market. When you look at the stock market and the extremely high CAPE values, it’s easy to say “OK – maybe I have enough in the stock market and it’s time to look at other things.”

If that describes you, I think it’s worth a look.