I’ve invested in real estate before. With less than stellar results.

It was a small little partnership that invested in single family homes in Kansas City. The homes were very small, in a blue-collar neighborhood, and things were fine when they were fine. We had a partner on the ground managing it but eventually little problems started snowballing. We would eventually sell the properties, take a small loss, and move on.

We were not good at finding homes. We were not good at vetting them. We were not good at managing them. And I personally never got better and so I was happy to move on.

I still believe in real estate but I don’t believe in me as an investor in real estate. I am not disciplined enough to analyze individual opportunities, follow through on execution, and in real estate it’s all about execution.

I’ve dabbled in this new era of crowdfunded real estate investing, with a small investment in a property via RealtyShares (which has since shut down), but it’s looking like PeerStreet is an appealing option.

🚨🚨🚨 Peerstreet recently filed for bankruptcy. As such, we no longer recommend working with Peerstreet. The review below was written prior to their filing. Here is a list of PeerStreet alternatives that you should consider instead.

Let’s dig deeper with a look at Peerstreet:

Table of Contents

What is PeerStreet?

PeerStreet is a commercial loan marketplace where people invest in high-quality real estate loans. It gives you, as an investor, an opportunity to diversify some of your investment portfolio into the commercial real estate sector. They announced in October 2017 that they’d funded over half a billion in loans and they’ve raised over $21.1 million venture funding from the likes of Andreessen Horowitz and Rembrandt Venture Partners (among others).

Here is their explainer video:

PeerStreet is democratizing the process, by enabling you to invest in this asset class with as little as $1,000. This is a pretty low minimum, most other real estate crowdfunding sites have higher minimums. Realtymogul has a $1,000 minimum with many of the more appealing loans requiring higher minimum.

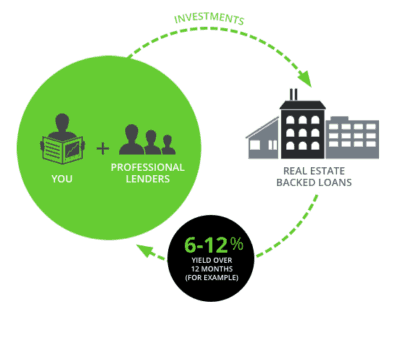

PeerStreet is similar in concept to other peer-to-peer platforms (you lend money to borrowers) but these borrowers have real estate as collateral. For many, they’re commercial real estate investors who need financing to fund their ventures. Those investors are referred to as “originators.”

The end result is that you’re investing in commercial mortgages. These are not like the typical 30-year mortgages made to homebuyers because there are loans of amny different types. Loans vary in length, property type, location, loan-to-value, and maturity. Common loan types include originators purchasing single-family residences with the intent to either rent the property out or sell at a profit (fix-and-flip).

When you invest through PeerStreet, you’re not investing in the commercial real estate directly. You’re investing in the loans secured by the property. And, like with other peer lending platforms, you’re not committing to the entire loan, just smaller amounts in the form of notes.

Each note has a minimum investment of $1,000. That means that if you invest $10,000 in PeerStreet, you will be able to spread your investment across at most 10 different loans. That will provide you with a measure of diversification against the risk of default by any individual loan.

Signing Up with PeerStreet

You can open either a general investment account or a self-directed traditional or Roth IRA through PeerStreet. Whichever account you choose, you will need a minimum initial investment of $1,000 to open the account.

To open an account, you must be an accredited investor. That’s a high income/high net worth investor. To be an accredited investor, you must meet the following qualifications:

- You must earn an income of over $200,000 per year – or $300,000 if you’re married – in each of the previous two years.

- You must have a reasonable expectation of that income level continuing.

- If you don’t meet the minimum income requirements, then you must have a minimum net worth of over $1 million – which does not include the value of your primary residence.

The high financial requirements are necessary since investing in commercial loans is considered to be a more sophisticated investment, requiring individuals who can “afford” to lose money, should that be the case. For that reason, PeerStreet isn’t suitable for new and small investors.

To sign up for PeerStreet, you must supply your name and email address, and then create a password. Once you do, you’ll be required to provide the typical information needed to open any investment account. This will include either your Social Security number or your taxpayer ID number in the case of a business.

You will be asked to disclose income and net worth information, as well as your investment experience, and your risk tolerance.

Funding your account is easy. Once your account has been opened, you can fund your account with a wire transfer or an ACH bank transfer. Cash held in your account is held on deposit through City National Bank. Any cash held in your account is fully insured by FDIC for up to $250,000 per depositor. However, your actual investment in loan notes on the platform is not covered by FDIC (as is the case with any investment).

Investment Options at PeerStreet

PeerStreet gives you the ability to choose which loans you will invest in. Since you can invest as little as $1,000 each, this gives you the ability to diversify your holdings across many loans. You can invest in whole loans if you want, but you’re not required to.

If picking the loans seems out of your league, you can opt for automated investing too.

What is Automated Investing? You set the parameters for the type of loan you want to invest in and Peerstreet handles the rest. For example, you can choose the specific type of property, investment strategy (buy-to-rent, fix-and-flip, etc.), or loan-to-value ratio (LTV). The Automated Investing tool will select loans based on that criteria. This will eliminate the need on your part to investigate every loan that you will invest in.

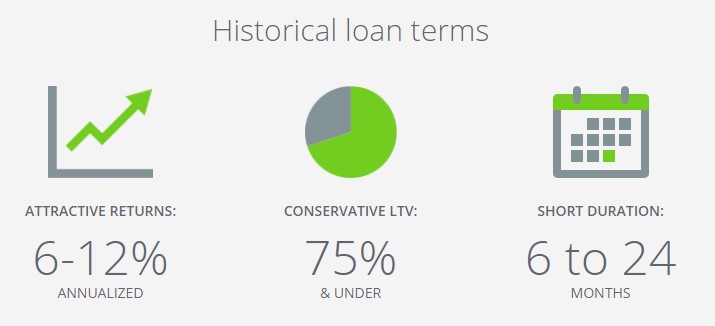

PeerStreet fully vets all originators and loans before making them available to investors. Loans have short terms, generally between six months and 24 months. LTV’s are typically below 75%, which reduces the overall risk of each loan. They project that a diversified portfolio will provide an annualized return of between 6% and 12% per year.

Lastly, loan terms are 6-24 months. There’s no secondary market for these notes so you’ll have to hold them until maturity.

What is PeerStreet’s Fee Structure?

There are no fees to open or maintain your account but PeerStreet will collect a spread on each loan.

This will range between 25 and 100 basis points (0.25% and 1.00%) taken out of interest payments. For example, if the interest rate on the loan is 10%, and PeerStreet has assigned a 75 basis point (0.75%) fee to the loan, your net return on investment will be 9.25%.

Since it’s based on the interest payment, if you don’t get paid, they don’t get paid… which is a small consolation since you not getting paid means the loan might default. 🙂

How PeerStreet Handles Loan Defaults

With any loan, defaults can happen. You diversify your holdings so you limit your exposure to defaults and look at the return of the portfolio as a whole.

With other peer to peer lending, if those loans are unsecured then you have no recourse. With PeerStreet, since the loan is secured by property, there is a much better chance you can recover some or most of your investment since it is secured by that property.

PeerStreet has a formal process for handling loan defaults. Defaulted loans are held in a bankruptcy-remote entity, separate from PeerStreet’s regular business. There, they will set up a workout process, designed to protect investor interests by maximizing liquidation proceeds. They have a dedicated staff in this capacity, who are experienced in commercial lending, law and regulatory compliance.

As of October of 2017, PeerStreet has originated $500 million in loans and have experienced zero investor losses.

Is PeerStreet a Good Investment?

🚨🚨🚨 Peerstreet recently filed for bankruptcy. As such, we no longer recommend working with Peerstreet. The review below was written prior to their filing.

Peer-to-peer investing is becoming increasingly popular, particularly since interest earnings on more traditional investments, like certificates of deposit and money market funds, are so low.

PeerStreet is one of the few platforms available where you can invest in commercial real estate loans. This will give you an opportunity to diversify away from traditional fixed income investments. And you can invest in a loan with as little as $1,000, which isn’t hard to take either.

Unlike investing in stocks or mutual funds, PeerStreet loans are not tied to the performance of the underlying investment. Since you are investing in loans, and not the actual equity of the property itself, you will be paid on your investment, even if the originator doesn’t make money on the transaction.

The loans are relatively short-term. On other P2P platforms, loans have a typical maturity of between three years and five years. PeerStreet loans are limited to no more than 24 months and are frequently shorter. That means that the payback period is shorter and reduces your risk exposure.

Another advantage is that the loans are secured by property. This is an important factor that distinguishes PeerStreet from other popular P2P investment platforms. All investments made through PeerStreet are in loans secured by real estate. Most other types of P2P loans are completely unsecured. That means that if a loan goes sour, you can lose your investment. PeerStreet offers an opportunity to recover your investment through the securing property.

That doesn’t mean that investments in PeerStreet are risk-free. But it does mean that you will have more recourse than you will have with other P2P investments.

Finally, your investment in commercial real estate loans is not liquid. Once you invest in a loan or a note, you must hold your position until the loan is paid off. There is no capacity for you to cash out your investment, either by selling it to other investors, or by selling it back to PeerStreet.

Wise Money Tips says

Sounds like a great way to diversify not only your real estate investments, but your portfolio overall. The minimum is very low, but unfortunately, most individuals do not qualify as accredited investors.

Ducheznee says

The $1,000 minimum seems to target small, curious, unsophisticated investors. But the minimum income requirement excludes those very same people. Too bad, really. Sounds like a really cool system.

The minimum is meant to help you diversify so you can invest as little as $1,000 each in a wide range of investments.

The accredited investor requirement isn’t theirs, it’s the SEC’s requirement.

Nas says

Nice post, thanks. I put in 20k in Dec spread out in mostly 1k increments all over the country. They’ve been paying interest for 4 months so far and no problems. Two tips:

1) Assuming you get there through a referral, you’ll get a bonus 1% interest on each of your first 2 investments, so you should make those investments larger than the subsequent ones (I did 5k instead of 1k).

2) Sometimes the principal for a loan will be paid back very early, as in a month or two into the loan. In that case you make very little interest off that loan, but they have a nice feature where your 1k (or however much) gets reinvested in the next batch of loans that shows up on the site. Mine was sitting idle for a day or less.

Steve says

I agree with you on the investor side. I don’t really believe in myself as a real estate investor either. For one I’m not very passionate about it, and for two I don’t have a lot of time. However, something like PeerStreet seems like a great way to invest in real estate without the commitment or in-depth knowledge (although I would still read and review) of owning a home and renting it out. I also agree that this is a great way to diversify, if you’re accredited of course.