Ally Bank

Product Name: Ally Bank

Product Description: Ally Bank is an online bank that offers checking, savings, money market, and certificates of deposit. It's my primary bank because there's an easy mobile deposit feature, bank to bank transfers, $10/month ATM reimbursement, and an app that is easy to use. They don't often have the highest interest rates available but they're usually close enough that I'm satisfied.

Summary

Ally Bank is an FDIC insured online bank that was formerly known as GMAC Bank (name changed in May 2009). In addition to Ally Bank, their parent company also operates Ally Invest, which was formerly known as TradeKing before it was acquired by Ally.

Pros

No minimums, no maintenance fees

Overdraft protection if you have a savings account

$10 per statement ATM reimbursement (automatic)

Mobile deposit of paper checks

Cons

Competitive interest rates but not highest

No business accounts

Can’t deposit cash

Thinking about opening a bank account and wondering if that bank should be Ally Bank?

Ally Bank is an online bank with high-interest checking and savings accounts that will embarrass your local brick and mortar bank options.

Years ago, I made Ally Bank my main online bank. I still keep a Bank of America account for quick ATM access, despite Ally’s ATM reimbursement program, but I keep that around because of inertia more than any other reason. It’s the center of my financial map and one of my favorite savings accounts available.

In this review, I’ll go through all of their offerings and you can decide if it’s the bank for you.

Table of Contents

Is Ally Bank Safe?

Ally Bank started as GMAC, the financing division of General Motors, and only got into banking services in 2000 with the creation of GMAC Bank. They were founded all the way back in 1919 and expanded their financing operations in the 1940s to include trains, then household appliances (1951), and financed their 75th millionth vehicle in 1977. In 2009, they rebranded from GMAC Bank into Ally Bank.

Ally Bank (FDIC #57803) is completely safe and FDIC insured up to $250,000.

Ally Bank has an extensive history in lending but for the purposes of this review, I look at their core banking and deposit products and my experiences with them as an online bank. They also acquired TradeKing and rebranded it Ally Invest (which I use as my discount broker too) so you can do nearly everything under one roof.

Ally Bank Deposit Products

Ally Bank offers the full suite of deposit products – savings, checking, and certificates of deposit (a High Yield, a Raise Your Rate, and a No Penalty CD).

| Deposit Product | Yield |

|---|---|

| Online Savings Account | 4.35% APY |

| High Yield CD – 3 months | 3.00% APY |

| High Yield CD – 6 months | 5.05% APY |

| High Yield CD – 9 months | 4.95% APY |

| High Yield CD – 18 months | 4.65% APY |

| High Yield CD – 36 months | 4.00% APY |

| High Yield CD – 60 months | 4.00% APY |

Interest Checking Account

The interest checking account has no minimums, no maintenance fees, and an interest rate that crushes traditional brick and mortar banks. The interest rate is currently at 0.25% APY. You can transfer instantly between the savings and checking account (keep in mind the Fed’s 6 ACH transfer rule) so you should keep the minimum you need in the checking.

The checking account also offers bill pay and Zelle for payments to other individuals. The debit card is nothing extraordinary, it’s a regular debit MasterCard.

How do I withdraw cash from my Ally Bank account? To get cash from your Ally Bank checking account, you have to use your debit card at another bank’s ATM. Ally Bank won’t charge you a fee when you use another bank’s ATM and they will automatically reimburse the other bank’s fees of up to $10 each statement cycle. They have also partnered with the Allpoint ATM network (43,000+ ATMs) so if you use that network’s ATMs then you won’t be charged a fee.

With a brick and mortar banks, if you use another bank’s ATM then you usually pay two fees – one by the bank that owns the ATM and one by your bank. Many online banks partner with ATM networks to give you fee-free ATM access but not many offer reimbursement of fees like Ally does.

With their debit card, you can also get cashback from purchases without a fee.

Ally Bank has a daily ATM withdrawal limit of $1,000 per day.

How do I put money into my Ally Bank account? You can transfer money into your account via an ACH transfer, you can deposit checks through the app, and you can mail in checks using their prepaid envelopes (or mail it directly yourself to Ally Bank, P.O. Box 13625, Philadelphia, PA 19101-3625). You can’t deposit cash directly into the account, Ally Bank doesn’t accept cash deposits. To get your cash into an account, you have one of two options. You can deposit at a different bank account and then transfer it or you can buy a money order and deposit the money order.

Online Savings Account

The online savings account has no minimums, no maintenance fees, and a high-interest rate that applies to all balance tiers.

The Online Savings Account interest rate is 4.35% APY and compounds daily.

Ally Bank also has a money market account with a tiered interest rate:

- < $5,000 minimum daily balance: 4.40% APY

- $5,000 minimum daily balance: 4.40% APY

- > $25,000 minimum daily balance: 4.40% APY

I mention it because it exists, and may become a factor in the future, but right now it’s inferior to the savings account.

Savings Buckets Feature

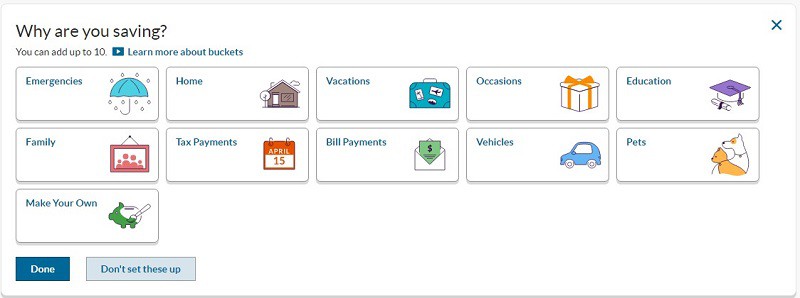

Ally Bank recently added a new feature to their savings accounts – “buckets.” Buckets are ways to organize your savings without having to create separate savings accounts. There are ten pre-made buckets (Emergencies, Home, Vacations, Occasions, Education, Family, Tax Payments, Bill Payments, Vehicles, Pets) and a “Make Your Own”. When you pick the ones you want, you’ll get those plus one called “Core Savings.”

Afterward, you can distribute the amount in your savings across the various buckets to help you understand how your money is being allocated. It’s all still in your savings account but can help you understand how you’re saving towards each goal.

Finally, you can set how you want new money to be allocated into each bucket. You can keep it 100% Core Savings and manually distribute it or you can set percentages on each category.

Finally, you can set the bucket where interest is deposited (you can only select one category for this).

Savings Boosters

Savings Boosters are under the “Optimize” tab and consist of two features:

- Recurring Transfers: Set up a referring transfer to help you save money.

- Surprise Savings: This is where Ally analyzes your checking account (that you add yourself) and it transfers money when it could work harder in savings. It never transfers more than $100 at a time and only does it on Monday, Wednesday, or Friday.

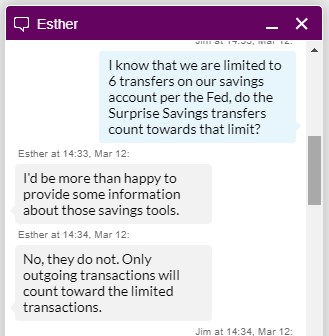

Surprise Savings transfers do not count towards the 6 ACH limit (the six transaction limit on savings accounts was rescinding on April 2020).

These two features are less exciting than buckets but they’re nice little bonuses.

Certificates of Deposit

There are three types of CDs:

- High Yield CD: This is their name for a standard certificate of deposit. They have all the standard maturity periods up to 60 months (5yr).

- Raise Your Rate CD: This type of CD allows you to raise your rate should rates increase for your term and balance tier. It’s available as a 2yr and 4yr CD. You can increase the rate one-time on the 2yr and two-times on the 4yr.

- No Penalty CD: You can withdraw your money at any time and pay no penalty. The only exception is that you can’t withdraw within the first six days. This is currently available for 11-month terms only. (if a no penalty CD interests you, our list of no penalty CD rates has some competitive offers)

On top of all this, they have a “Ten Day Best Rate Guarantee.” If the rate for your CD’s maturity and balance tier goes up in the first ten days of opening, they will increase your rate to that higher rate. There’s no fear that you open a CD and suddenly the rates go up and you miss out.

Ally Bank has one of the most generous CD early withdrawal penalties I’ve ever seen –

- 24 months or less: 60 days of interest

- 25 months – 36 months: 90 days of interest

- 37 months – 48 months: 120 days of interest

- 49 months or longer: 150 days of interest

Finally, when you renew your CD you get a “Loyalty Reward.” When rates were higher, I saw Loyalty Rewards of almost half a percent. It’s less generous these days but still better than nothing!

Hi Jim, we currently offer a .05% Loyalty Reward for CD renewal, and will keep the community updated on any future offerings as they become available. Please let us know if we can answer any further questions! ^KM

— Ally (@Ally) February 22, 2018

Retirement CDs & Savings

At Ally Bank, you can open an IRA, Roth IRA or SEP-IRA version of the High Yield CD, the Raise Your Rate CD, and even an IRA Online Savings account – all with rates that are comparable with the non-IRA versions. As someone who is in their mid- to late-thirties, this isn’t appealing BUT it might make sense for someone who is nearing retirement and looking to squeeze a little extra return out of their retirement cash holdings.

Ally Bank Fees & Penalties

Ally Bank has no monthly maintenance fee, no minimum account balance, and no fee for incoming wires. You can get cashier’s checks for free and get unlimited deposits too.

You do pay a fee for:

- Returned deposit item: $7.50

- Overdraft item (maximum 1 per day) $25

- Excessive transactions: $10 per, this is based on the 6 ACH rule

- Outgoing wires (domestic): $20

Pros and Cons

Ally Bank offers every good feature of a bank and avoids any negatives. A competitive interest rate on all their products as well as no minimums and no maintenance fees.

Competitive Certificates of Deposit rates: The certificates of deposit rates are competitive with a generous early withdrawal penalty, should you need to, plus a small loyalty renewal bonus if you re-up a CD. The No Penalty CD and Raise Your Rate CD options are nice for some flexibility but their rates are typically lower than the regular CD, but that’s to be expected since you are paying for that flexibility.

Cashback rewards card: If you want a no annual fee rewards card, Ally Bank has one that gives you 2% cashback at gas stations and grocery stores, 1% elsewhere. You also get a 10% bonus when you deposit the cashback into an Ally Bank account. Finally, a new sign up bonus of $100 bonus when you make $500 in purchases.

No-Commission Discount Brokerage account: If you don’t have a discount brokerage account, Ally Invest is well-integrated with the bank and offers free trades, no account minimum, and no surprise fees. It also offers the most generous new account brokerage promotion with up to $3,500 in cash depending on how much you deposit.

Finally, Ally Bank has a very easy to use a smartphone app that includes eCheck depositing, a must these days because who wants to mail checks for deposit? If that describes you, they offer postage prepaid envelopes you can use to mail the checks. If you need to reach them, they have email, phone (1-877-247-2559), and online chat.

As for Cons, I really can’t think of any that apply to Ally Bank and not to other online savings accounts. Ally Bank will periodically run new account bonuses but there isn’t one right now. Sometimes it’s nice to be able to go to a branch… but I may love the option of it more than actually doing it. The only feature that another bank offers that Ally doesn’t is the ability to quickly create new savings or checking accounts, as I do with Capital One 360, but they simplified that with Buckets.

Final Verdict

If you’re comfortable with an online bank, I can’t think of a better one than Ally Bank. It’s the reason why I opened an account with them many years ago and the reason why I still use them today.

Kerry says

Thank you for the informative post. I’ve been looking into Ally, and I think it’s a pretty solid place to take my money. I’m currently banking with a credit union (member of co-op), and I might maintain that account for cash deposits, atm’s, etc, if I decide to start an online banking account. What are your thoughts on this? Also, what are your thoughts on the similar CIT Bank? Thank you.

I use Ally Bank and am a big fan, as you can probably see in the review, and I have not tried CIT Bank yet. I don’t rate chase with banks so their slightly higher rate on their “savings builder” product doesn’t matter all that much to me.

DSJ says

There are only two negative things I have ever run across with Ally.

The first bad been mentioned, inability to deposit cash. ATMs take cash deposits so I’m surprised Ally hasn’t worked out a solution.

Second is related to their bill pay service. An Ally customer can do nearly anything on the Ally app except the ability to add payees. Adding payees must be done on the Ally web site, and from a computer. Accessing the web site from a mobile browser is not allowed for this function, although there is a work around for the tech savvy.

I hadn’t tried using bill pay on the app so I didn’t know about this limitation, seems odd that they wouldn’t let you add it on the app. Is the workaround to request “desktop version” in a mobile browser?

Mariah says

So you not able to make cash deposit so how you get money on your card ??

You can deposit checks via the mobile app or you can transfer it from another bank.

Bob says

Do they have text messages alerts ???

Yes, from their FAQ: “We send security, transfers and other alerts automatically to help you keep track of your account activity. You can create custom alerts to stay on top of balances, deposits, overdrafts and transactions.”

You can change what alerts they send but there are automatic alerts you can’t unsubscribe from because they’re for your protection (like transfers).

Meg says

Can i only transfer 6 times INTO an Ally savings account from another bank without excessive transaction fees?

This limitation is for ALL savings accounts at any bank. You can make the transfers to a checking account though, there are no restrictions regarding that.

sanjay says

Not sure where you got this information. I use marcus and there is NO limit on the number of transactions per month

The Federal Reserve only recently (April 24, 2020) removed the six-per-month limit. My comment was a week or so before the interim final rule.