There’s a running joke in our household that my wife gets AARP solicitations because of her name.

It’s a little old-fashioned, like Thelma or Gladys (but not those), and unlikely to make a comeback (sorry honey!).

We get the mailings because AARP uses the postal service’s geographic mailing service, it’s literally spam by mail without the CAN-SPAM protections.

The other day, I wondered if perhaps the American Association of Retired Persons just might be worth it. It currently boasts 37 million members. And not every one of them is retired.

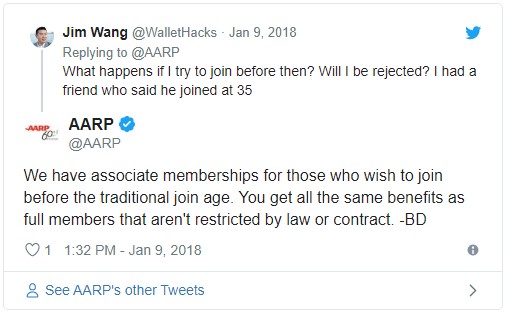

In fact, you might think that there must be some kind of age restriction. Other websites will say that you have to be 50+ to join… but AARP never does.

One of my college friends, Roger, tested that theory and joined.

He’s a Certified Financial Planner and runs a financial planning firm, lifelaidout, in New York City. He works with people across the country to help them reach their financial goals, live great lives, and achieve peace of mind.

He’s also an AARP member.

I wanted to know why… and how.

Take it away Roger!

While some 30-somethings may never leave home without their American Express cards, I never leave home without my AARP card. You may be wondering, though, how and why a 35-year old working professional joined an organization that focuses on retirees. Here’s my story.

Table of Contents

Did You Know Anyone Can Join AARP?

For the longest time, I thought you could only join AARP if you were 50 or older.

It seemed like everyone who talked about AARP was in that age group. However, several years ago, I stumbled on a deals forum where people clearly in their 20s and 30s were debating whether to join AARP for the benefits. Just like that, a whole new world opened up to me.

AARP Membership Fees Are Crazy Low

The cost to join AARP is surprisingly low, to the point that you really don’t have to give it that much thought.

The regular price is $16/year, but if you sign up for multiple years at a time or enroll in automatic renewal, the cost could be as low as $12/year.

This pricing hasn’t changed in ages!

Also, your membership also allows you to add a spouse or partner for free. They even get their own membership card!

AARP Benefits

While being able to say you’re a member of AARP could justify the annual fee by itself, there are several other discounts on travel, dining, entertainment, and shopping that make the membership worthwhile.

Here’s a small sampling:

- Travel: You can save up to 15% at several hotel chains, including Hilton, Starwood, and Wyndham. In addition, membership gets you 10% to 25% discounts on car rentals from Avis and Budget Rent-a-Car, as well as select free vehicle upgrades, discounted GPS rates, and an additional driver at no cost.

- Dining: AARP offers 10% to 15% off at restaurant chains, such as Bonefish Grill, Denny’s, McCormick & Schmick’s, and Outback Steakhouse.

- Entertainment: Pay a base price of $9.50 for Regal ePremiere movie tickets purchased online, which are valid at all Regal Entertainment Group theaters nationwide. (Note: there is a processing fee of $0.50 per ticket for the first three tickets and $0.30 per ticket after that, as well as a location surcharge in certain markets, so the all-in-cost will likely be a bit higher.) In Manhattan theaters, the total cost with all surcharges comes to $11.50 per ticket—which is still a great deal, considering a matinee ticket in Manhattan ordinarily costs more than $17!

- Shopping: AARP often offers limited-time offers for everyday shopping purchases. For example, when I first joined, I was able to take advantage of a limited-time offer to purchase a $50 Lord & Taylor gift card for $40, an instant 20% savings! Given that my wife likes shopping there, we cashed in on the deal. In addition, AARP offers certain recurring deals. For instance, on the first Tuesday of every month, AARP members typically get 20% off regularly priced items at Walgreens and Duane Reade.

Since joining, I’ve been able to save $50 on Hilton hotel stays, $12 on movie tickets, $10 at Lord & Taylor, and $5 on purchases at Duane Reade—for a total savings of nearly $80, far exceeding the $16 membership fee.

There are no age limitations for joining AARP and the annual fee includes the ability to add your spouse or partner to take advantage of the benefits as well.

Whether it makes sense for you to join will depend on your specific situation. The savings from one hotel booking could more than offset the annual fee.

And at a cost of $12 to $16, why give it that much thought? Just do it.

Jim’s back.

Roger shared some of the benefits that resonated with him but there are so many more reasons out there. Just look at the laundry list of places that will give you a discount if you show them an AARP card. It’s enormous.

Many reward programs, like Walgreens, will give you more points if you link your AARP membership card to their program. Walgreens will give you an additional 50 Balance Rewards points for every $1 you spend on Walgreens-brand health and wellness products. 1,000 points for vaccinations.

I wish we knew this when we had pet insurance through Petplan because you get 10% off premiums plus you get a Visa prepaid card up to $35!

Where AARP Benefits Shine

I asked another friend of mine about AARP membership and he told me that the biggest benefits are in the dining discounts.

Many of the other ones, like the hotels and shopping, are available if you’re a member of other affinity groups, like AAA.

With dining, those discounts are often better with AARP membership as long as you frequent those restaurants often.

AARP also has a new section of the site called AARP Games. Many of the games are free but some are only for members, like Blackjack and Canfield Solitaire. You can play crosswords, word search, MahJongg Candy, etc. It’s an impressive list of games that can keep your mind sharp without costing you a penny.

How Much is AARP?

If you are within 6 months of your 50th birthday, you can opt for an annual, 3-year, or 5-year membership:

- 1 year – $12 (with automatic renewal, $16 without)

- 3 years – $43 ($14.34 per year)

- 5 years – $63 (12.60 per year) — right now they’re running a promotion where it’s just $9 a year if you sign up for five full years.

You could easily save that each year.

If you aren’t that close to your 50th, you can sign up for an Associate membership. For that, you need to call into an AARP office.

In other words, anyone can join AARP. AARP later clarified and said that anyone under 50 would have to call to sign up, but I feel like you could just fill out the form online. When I entered in an under-50 birthday, the form didn’t complain.

Give AARP a look – I think you’ll be surprised. Turns out they were right — you don’t know AARP. Neither did I!

Lazy Man and Money says

I was kind of on the fence as to whether I’d use the membership. With my wife’s active duty status, we get a number of similar discounts.

However, I saw the deal with Dunkin Donuts and I think that alone could pay off.

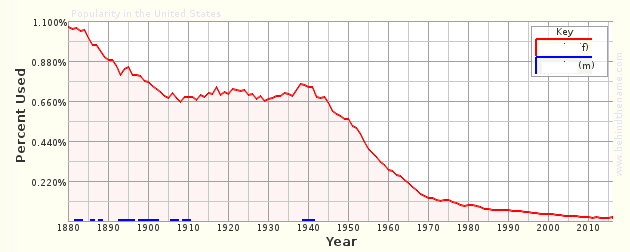

The decline of people named Ruth is very steep ;-).

🙂

kat says

Wouldn’t pay off for your health!

Butch Schutte says

Does AARP provide discounts for legal services such as a will and trust, and power of attorney fees?

The discounts will vary from time to time so it’s not always clear what is available when. They don’t appear to have a discount with Will & Trust at this time (March 2021).

Doris Steiner says

I am so glad I read this blog! It was informative in helping me make the decision to join AARP.