Kikoff offers a simple service – get a $750 line of credit with a $5 monthly payment that helps you to build credit by establishing a regular payment history that reports to the major credit bureaus.

Some of the products may also help improve your money management and professional skills while helping your credit score.

This Kikoff review shows how this tool can help improve your credit score and if it’s worth using.

Table of Contents

What Is Kikoff?

Kikoff is a fintech service (available on both Android and iOS) launched in 2019 and is a low-cost way to improve your credit score. A website is also available for computer and web browser access.

The platform collects monthly payments as small as $5 and reports the on-time payment to all three credit bureaus – Equifax, Experian, and TransUnion.

The reporting depends on the product:

- Kickoff Credit Account reports to Equifax and Experian

- Credit Builder Loan reports to TransUnion and Equifax

Each payment can strengthen these credit score factors:

- Payment history (35% of your credit score)

- Credit utilization (30%)

- Account age (15%)

- Credit mix (10%)

You may consider this service if you desire to build credit without a credit card.

Where Is Kikoff Available?

Kikoff currently works in 49 states (as of February 23) and has ambitions of operating in every U.S. state.

The service is only unavailable in the state of Delaware.

You must be at least 18 years old to join Kikoff.

How Much Does Kikoff Cost?

There are several different services you can enroll in and pay a fixed monthly payment for each product. Unlike some credit building programs, you won’t pay these fees:

- Interest charges

- Late fees

- Administrative fees

- Hidden fees

- Early repayment fees

However, missing a payment can hurt your credit score despite the lack of fees.

It’s free to join, and there are no financial commitments until you review the credit agreement and repayment schedule.

Kikoff Credit Account

A standard Kikoff membership costs $60 per year through $5 monthly payments. You don’t pay fees until you review and commit to the credit agreement. The program is scheduled to auto-renew each year.

If you cancel your account early, you must pay off the remaining balance in full, as the membership period is for 12 months. Thankfully, it’s cheaper to cancel than a gym membership.

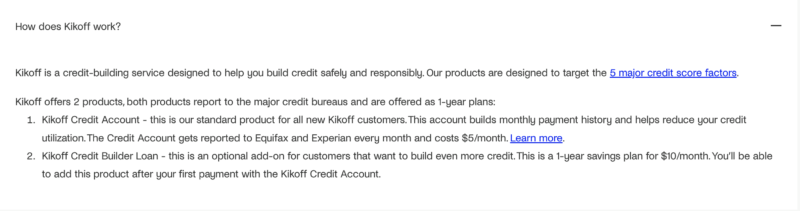

Kikoff Credit Builder Loan

The Kikoff Credit Builder Loan is an optional $10/month savings plan that can be added after you make your first payment on a Kikoff Credit Account. The purpose of this loan is to further build your credit.

Minimum Monthly Payment

You must make monthly payments similar to an installment loan or credit card. After the monthly billing period closes, you have 25 days to make the payment on time. If you purchase multiple items, your minimum monthly payment is either $5 or 5% of your new balance (whichever is greater).

However, any unpaid balance from last month is due next month, and missing a payment can freeze your spending power.

How Kikoff Works

You can get started with Kikoff in four easy steps:

- Open a free Kikoff Credit Account

- Commit to a 12-month term ($60/year)

- Make $5 monthly payments from a linked account

- Kikoff reports each payment to the credit bureau

Joining Kikoff is free; you only pay a monthly fee when you commit to a credit-building service. For example, an annual membership costs $60 with a $5 monthly payment. You will see the payment due date, and you can fund your monthly payment from a linked bank account, debit card, or credit card.

No hard credit check is necessary, but you must provide your Social Security number and contact information to open an account. These details are required to report your monthly payments correctly.

It can take approximately six weeks for each payment to appear on your credit reports. As a result, your score may rise but not as soon as you anticipate.

Kikoff Credit Account

The first step to building credit with Kikoff is opening a revolving credit line with a $750 spending limit.

It’s similar to a credit card, with a preset spending limit and minimum monthly payments. However, you can only use this credit to purchase an annual membership or buy ebooks in the Kikoff store. At a minimum, you must choose the Kikoff Credit Service ($60 annually) to be an active member.

The app recommends keeping your credit utilization ratio below 10% of your limit to see the most upside. Because the $60 annual payments consumes 8.0% of your available credit, you’ll want to stagger your ebook purchases.

These payments report to the Equifax and Experian credit bureaus. Unfortunately, this activity won’t help your TransUnion credit score. As most lenders pull your credit from at least two bureaus, the lack of reporting to all three bureaus is a nuisance but not a dealbreaker.

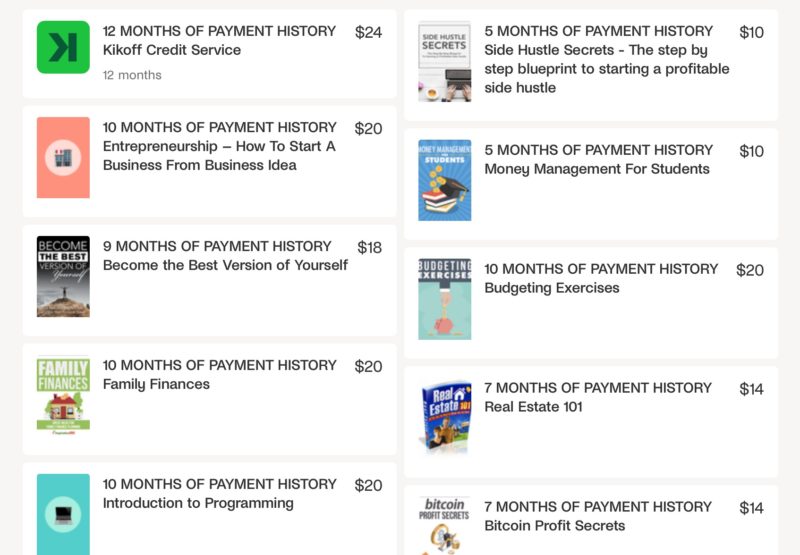

Kikoff Store

The only other way to spend your Kikoff credit limit is by purchasing ebooks from the online store. Each product costs $5 per month, can build credit, and costs between $10 and $20.

These books cover these topics:

- Budgeting

- Making money

- Investing

- Paying off debt

- Productivity

- Starting a business

These books can help expand your horizons, but the product descriptions are brief. In addition, several customer reviews indicate that book purchases are usually better for building credit than learning something new.

Credit Builder Loan

While this product is no longer available to new members, existing Kikoff members may qualify for a credit builder loan and recoup the loan balance at the end of the repayment period.

If you’re an existing member with this feature, you can make monthly payments that report to TransUnion and Equifax.

Monthly Credit Score Updates

After opening your credit plan, you will receive monthly credit score updates to track your progress. The platform provides your VantageScore 3.0.

Kikoff Learning

In addition to the paid self-help books, you can read free credit tips to learn more about financial topics. The paid books will provide more information and can also improve your score.

Kikoff Pros and Cons

I like that Kikoff has no hidden fees or interest and that the monthly payments are manageable. It makes for a low-risk way to build credit.

Pros

- Monthly payments report to the credit bureaus

- No hidden fees or interest

- No hard credit check

Cons

- Credit line only works at Kikoff Store

- Doesn’t report credit account to TransUnion

Can Kikoff Build Credit?

Kikoff can increase your credit score with on-time payments. It’s possible to start seeing an increase after the first month, but it can take several months to reap the full benefits as your account age increases.

Customers with no credit or a low score can see the most improvement. Some testimonials report seeing an increase between 20 and 100 points within a few months. Of course, results vary by person, and you must practice other good practices to see a higher score increase.

If you’re unsure where to find your credit score, here are 13 ways to check it for free.

Unfortunately, the standard Kikoff Credit Account only reports to the Equifax and Experian credit bureaus. Neither will it improve your business credit score.

Kikoff Alternatives

These credit-building services can also be worth using to strengthen your credit history.

Self

A Self Credit Builder Account lets you contribute between $25 and $150 per month for up to 24 months into a credit building account. Your payments report to all three bureaus, and you receive your payment amount back (minus administrative fees) at the end of the loan.

After opening a credit builder loan, you may also decide to open a Self Visa secured credit card. This additional account can build credit and doesn’t incur additional fees. For more information, check out our Self Credit Builder Review.

Chime

Chime can be an all-in-one banking and credit solution. When opening a free checking account, you are eligible for a fee-free Credit Builder secured Visa credit card. Your spending limit is the same amount as your refundable security deposit, and your monthly payments report to all three bureaus.

In addition, this service offers high-yield savings account without fees or minimum balance requirements. Other banking perks include online bill pay, surcharge-free ATMs, and overdraft protection up to $200. Learn more in our Chime Bank Review.

Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. The Chime Visa® Debit Card is issued by The Bancorp Bank or Stride Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted. Please see back of your Card for its issuing bank.

Extra Card

The Extra Card is a rewards debit card that connects to your checking account to pay for your purchases. While Extra functions like a debit card with daily balance payments, your payment history reports to the three credit bureaus. Your purchases can earn 1% back, and annual plans start at $149 or $20 a month. Get all of the details in our Extra Debit Card Review.

Kikoff Review FAQs

No, Kikoff is only a $750 credit line that lets you make monthly payments by enrolling in the Kikoff credit service or buying ebooks from the platform’s marketplace. If you want a secured credit card, you will need another service to build credit while shopping online or in-store.

You can only use your Kikoff Credit Account within the Kikoff website or app. The standard membership plan costs $60 annually and reports each monthly payment to Equifax and Experian. It’s also possible to buy ebooks ($10-$20 each) on the platform with $5 monthly payments that also report to the credit bureaus.

You can enroll in monthly autopay for your Kikoff Credit Account and ebook purchases. Kikoff will withdraw the payment from your linked checking account or payment card. It’s also possible to pay off a balance early without prepayment penalties, but the remaining monthly payments won’t report to the credit bureaus as your balance is paid off.

You can submit questions through your account or visit the support center for knowledge base articles. Unfortunately, Kikoff doesn’t provide phone-based customer service.

Kikoff Review: Final Thoughts

Kikoff can be less expensive than a secured credit card or credit builder loan, though the $750 credit limit is relatively small, and you only have a few ways to use the available credit.

Overall, Kikoff is an easy and cheap way to start building credit or repairing a damaged score. Just keep in mind that it isn’t a be-all or end-all. You’ll eventually need to incorporate other credit products to build an excellent credit score.