Are you looking to find out how much it’ll cost you to prepare your taxes with TurboTax in 2023-2024?

TurboTax has several versions and in this article, you’ll learn how much it costs to prepare you taxes for Tax Year 2023.

(the Tax Year 2023 is the tax year that you’ll be filing on the tax deadline in 2024, which is April 15th, 2024.)

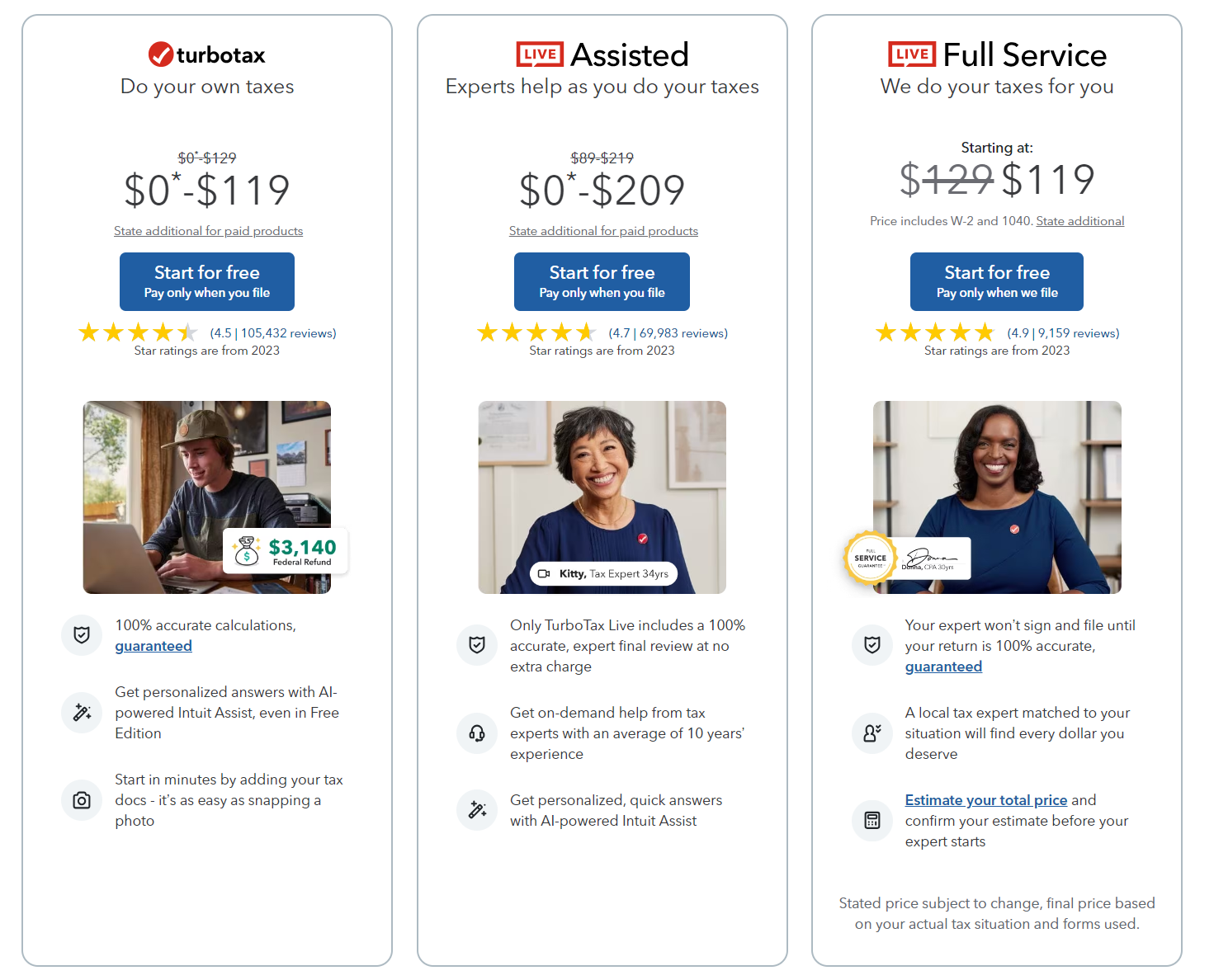

When you go the TurboTax website, you don’t see the familiar packages like Deluxe, Premium, Home & Business, etc. anymore.

For marketing purposes, they’ve organized it by the level of “assistance” you need.

The ranges are accurate but it doesn’t show you the pricing until you click on the “Start for free” button. You have to register, start the tax preparation process, and then you learn how much it costs.

I don’t think they’re being intentionally opaque, it’s just that the pricing isn’t completely clear.

If you’re confused, here’s how the pricing works:

Table of Contents

TurboTax Pricing Structure for Tax Year 2023

TurboTax still has three tiers of service – Free, Deluxe, and Premium.

The tiers are based on the complexity of your tax situation. This is exactly as it was for the last few years. The simplest returns may qualify for free. If you have a more complex situation, you’ll have to use Deluxe or Premium. (the Home & Business tier is gone, it’s Premium now)

They’ve also added another “option” and that’s whether you want to Do It Yourself, Do It With Help (Assisted), or have a professional Do It For You (Full Service).

This option, which changes the prices of each tier, is based on how much help you want in the tax preparation process. Doing it yourself is the cheapest and using their professionals is the most expensive.

There is also one other pricing wrinkle and it has to do with timing. If you prepare your taxes early, it’s cheaper. If you wait until the last minute, the slightly more expensive. And if you’re late, as in after April 15th, it’s even more costly.

You don’t want to be late… because you’ll owe penalties on taxes owed too.

Federal Returns: Do It Yourself Pricing

The cheapest packages are those in which you do all of the preparation and filing yourself.

The pricing is based on the package as well as the date you file the return:

| Federal DIY | November 30, 2023 – February 29, 2024 | March 1, 2024 – April 18, 2024 | April 19, 2024 – October 31, 2024 |

|---|---|---|---|

| TurboTax Free Edition ~37% of taxpayers qualify. Form 1040 + limited credits only. | $0 | $0 | $0 |

| TurboTax Deluxe | $39 | $59 | $69 |

| TurboTax Premium | $89 | $119 | $129 |

As you can see, the prices are cheapest when you file before March of next year. They go up by $20 for March and April, and then an additional $10 for extensions.

👉 Visit TurboTax to start your return

State Returns: Do It Yourself Pricing

| State DIY | November 30, 2023 – February 29, 2024 | March 1, 2024 – April 18, 2024 | April 19, 2024 – October 31, 2024 |

|---|---|---|---|

| TurboTax Free Edition State ~37% of taxpayers qualify. Form 1040 + limited credits only. | $0 | $0 | $0 |

| TurboTax Deluxe State | $39 | $59 | $59 |

| TurboTax Premium State | $39 | $59 | $59 |

State pricing goes up a little after the early filing period but remains the same afterwards.

Federal Returns: Live Assisted Pricing

If you want a little assistance with your return, you’ll want to go with the Live Assisted tier.

The pricing structure is similar to the Do It Yourself, just slightly higher:

| Federal Live Assisted | November 30, 2023 – February 29, 2024 | March 1, 2024 – April 18, 2024 | April 19, 2024 – October 31, 2024 |

|---|---|---|---|

| TurboTax Live Assisted Basic ~37% of taxpayers qualify. Form 1040 + limited credits only. | $0 | $0 through 3/31/24 $89 for 3/31/24 to 4/18/24 | $99 |

| TurboTax Live Assisted Deluxe | $89 | $129 | $139 |

| TurboTax Live Assisted Premium | $169 | $209 | $219 |

There is still a $0 cost solution it’s just no longer called Free, it’s now named Basic.

👉 Visit TurboTax to start your return

State Returns: Live Assisted Pricing

| State DIY | November 30, 2023 – February 29, 2024 | March 1, 2024 – April 18, 2024 | April 19, 2024 – October 31, 2024 |

|---|---|---|---|

| TurboTax Live Assisted Basic State ~37% of taxpayers qualify. Form 1040 + limited credits only. | $0 | $0 through 3/31/24 $54 for 3/31/24 to 4/18/24 | $0 / $54 |

| TurboTax Live Assisted Deluxe State | $49 | $64 | $64 |

| TurboTax Live Assisted Premium State | $49 | $64 | $79 |

Again, no “free” named version but it’s a similar structure.

Federal Returns: Full Service Pricing

TurboTax Full Service is where they do your taxes for you, similar to other tax preparation services, and the pricing is based on the complexity of your tax return. As a result, they only have “starting” prices, which include Form W-2 and the 1040. Additional scheduled and forms will likely add to the cost.

- For Nov 30 – February 29, the package starts at $89

- For March 1 – April 18, the package starts at $119

- For April 19 – October 31, the package starts at $129

The pricing for State is clearer:

- For Nov 30 – February 29, state preparation costs $49

- For March 1 – April 18, state preparation costs $54

- For April 19 – October 31, state preparation costs $79

You can save money by preparing your taxes early though you still need to wait for the IRS to tell us when they will start accepting tax returns. Typically, you’ll need to wait until early February. Entities, like your employer and banks, aren’t required to send forms until January 31st. Sometimes they will make them ready earlier, in which case you can get a jump on preparation.

👉 Visit TurboTax to start your return

TurboTax Pricing on Amazon

Amazon still sells the TurboTax software and for a limited time, they will give you a $10 Amazon Gift Card with your purchase:

- TurboTax Deluxe 2023 + $10 Amazon Gift Card

- TurboTax Deluxe + State 2023 + $10 Amazon Gift Card

- TurboTax Premier 2023 + $10 Amazon Gift Card

- TurboTax Home & Business 2023 + $10 Amazon Gift Card

- TurboTax Business 2023 + $10 Amazon Gift Card

How Does This Pricing Compare to Others?

When it comes to preparing your taxes, TurboTax is not the only company out there. There are plenty of TurboTax alternatives and they’re worth taking a look at.

If you have a simple tax return, you may want to give FreeTaxUSA a look. They are free and state taxes are just $14.99. If your tax situation is more complicated and you don’t qualify for free, the Deluxe package is only $7.99.

FreeTaxUSA offers priority support and live chat for assistance but you should really consider this comparable to the TurboTax Do It Yourself tier of service. You can’t expect hands on support for a completely free service (or $7.99).

H&R Block, which has been battling TurboTax for years, has an offering that is similar to the conventions TurboTax used in past years. They have Basic, Deluxe + State, Premium, and Premium & Business:

- Basic – $20 + $39.95 for state

- Deluxe + State – $39.20 + $0 for state (1 state included)

- Premium – $60 + $0 for state (1 state included)

- Premium & Business – $71.20 + $0 for state (1 state included)

Taxes can be a pain but understanding the various pricing shouldn’t be.

Hopefully we’ve cleared up it up for you!