Auction results: Laverda race bike for the road sells for £31k

1974 Laverda 750 SFC Sold by Gooding & Company, £31,130 When talk turns to Italian race bikes, MV Agusta and Ducati are usually mentioned – but don’t forget Laverda. In…

The best from the classic, historic and sports car market: buying, selling, auctions and memorabilia

The phrase ‘ultimate track-day car’ will be familiar to anyone who regularly scans the adverts in search of race-ready exotica – but it could be a description that’s wholly justified…

Not long ago I had the privilege of being driven around the Spanish circuit Ascari in a Porsche 911 GT3 by the legendary Jacky Ickx. We were less than a…

2023 Aston Martin Valkyrie Sold by RM Sotheby’s, £2.4m Aston Martin’s F1-inspired, road-legal hypercar was in development for seven years between the idea being conceived in 2014 and delivery to…

Few names have left quite such an indelible mark across so many forms of motor sport as Lola, the company established by the late Eric Broadley in 1958 which grew…

1977 Wood & Pickett ‘Sheer Rover’ Sold by Bonhams online, £21,951 Although this rare Wood & Pickett Range Rover looked down at heel, it came with a glamorous history: the…

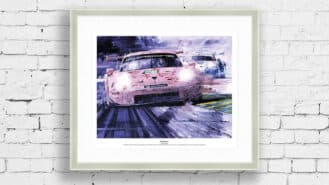

John Ketchell 2018 Le Mans Truffle Hunter print Porsche caused one of the great stirs of Le Mans history when it pulled the covers off its latest adaptation of the…

If proof were needed that a car doesn’t need to be the fastest, the rarest, the most valuable or the best-looking in order to be truly great, then Peugeot’s 504…

I’ve been lucky enough to enjoy a great 2023 season of competing with the Vintage Sports-Car Club, and every now and then I feel it’s right to give something back…