Goodwood’s got you covered, classic car owners

In association with There’s a lot of work that goes into owning a piece of motoring history. But then that’s part of what makes it so rewarding: a feeling of…

The best from the classic, historic and sports car market: buying, selling, auctions and memorabilia

In association with There’s a lot of work that goes into owning a piece of motoring history. But then that’s part of what makes it so rewarding: a feeling of…

In association with It’s been a big year for Ferrari, so spend more time celebrating than searching for cover for your classic by heading to Goodwood Classic Solutions. It was…

In association with When you think of classic 1960s sports cars it’s very difficult to not snap to thoughts of the Jaguar E-type – one of the prettiest sports cars…

Rear sets and silencers are high for maximum ground clearance Frame number confirms the bike as being one of the four Spaggiari racers This bike is extensively documented in a…

There was a time when the penultimate Type 964 series of Porsche’s air-cooled 911 were among the least-loved versions of Germany’s best-loved sports car. During the early 2000s, the ubiquity…

2022 McLaren 720S GT3X Sold by Bonhams, £402,500 This was one of just 15 examples of the £750,000, track-only 720S GT3X. Still regarded by many as the ultimate McLaren driver’s…

This sinister-looking restomod began life as a cooking model Vauxhall Chevette finished in custard yellow. But, following a 16-month transformation by Leicestershire-based Retropower – which specialises in unique vehicle builds…

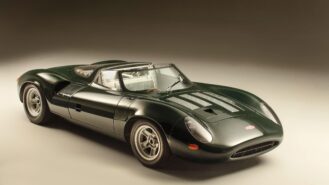

This impressive ‘evocation’ of the car that Jaguar hoped would mark its Le Mans comeback in the late 1960s has been priced at £20m-plus (on the advice of respected historic…

2006 McLaren MP4-21 Sold by RM Sotheby’s, £2m As Lewis Hamilton settles in with Ferrari, it’s not unrealistic to imagine that confirmed relics relating to his ground-breaking F1 debut with…

Described as “the winningest Cobra of them all”, this famed Shelby Cobra spearheaded Ford’s attack on both the SCCA A and B production series and the US Road Racing Championship.…

No muscle car aficionado would be fooled by it, but many a fan of the cult 1977 caper Smokey and the Bandit might do a double-take if they spotted this…