How the RS500s were created

The Ford Sierra RS500: a classic Class A projectile

Getty Images

It was a rush job, putting it mildly. Demand from teams wishing to convert race Cosworths to RS500 specification was overwhelming and the process couldn’t start until Ford had built all 500 and had homologation papers issued. So Ford contracted the job out to tuning firm Tickford, ear-marking the last 500 Sierra Cosworths for conversion.

You might think Tickford would receive the cars minus the RS500 components and just complete the job. Not a bit of it: what they got were fully finished Cosworths that then had to be part-dismantled and reassembled as RS500s. Extraordinarily, this meant exchanging engines that had never run for RS500 units. Even more bizarrely, none of the logbooks was altered to reflect this change so to this day all RS500s have the ‘wrong’ engine number. No one appears to know what happened to the 500 unused Cosworth engines that came out of the cars: Paul Linfoot from the RS Owners Club says Ford just came along and took them all away. It is possible they were used for early Sapphire Cosworths.

The cars were also built in random order, which is why their chassis number relates in no way to the order in which they emerged from Tickford. “Someone would just wander about the 500 cars in the car park with a set of keys in his hand until he found the car to which they belonged, and that would be the next car that got built,” says Linfoot. The first car went into build on April 9 1987 and the last emerged on August 30. All were meant to be black, but such was the rush not even that proved possible: 392 emerged in Henry Ford’s favourite colour, but there were also 52 Moonstone Blue examples and 56 white, including the four prototypes. Andrew Frankel

Aerodynamics

With echoes of a Porsche 911 whale tail, massive hatchback spoiler was designed to generate significant downforce to help glue the RS500’s rear slicks to the track. It was described in period as “functional”, but didn’t exactly prevent the cars sliding around. Says Andy Rouse, “It was fun to drive, with its massive excess of horsepower over grip and its habit of leaving snaking black marks on the track when you accelerated out of slower corners.”

Interior/body

Racing cabin is a cocktail of thoroughbred competition kit and standard odds and sods from the Ford parts bin. Bodyshells were seam-welded to optimise stiffness, but the regulations dictated that the rear hatch had to be operational and could not be welded shut to make the car more rigid yet.

Wheels/tyres

Group A rules permitted full racing slicks rather than road rubber – and several tyre companies took part, including Pirelli, Dunlop and Yokohama. In 1988 Andy Rouse ran his car on 17x10in BBS wheels with 240/630/17 Pirellis on the front and 240/655/17 Pirellis on the rear.

Suspension

There was a homologated suspension specification that required the standard MacPherson-strut front and semi-trailing arm rear suspension configuration to be retained, but teams were permitted to develop their own dampers and make certain other modifications.

Cooling

Extreme nature of the racing RS500 necessitated fitment of four separate coolers, one for the differential oil, one for the gearbox oil and two for the engine oil…

Engine/turbo

In standard trim the RS500 developed 224bhp – but larger turbo and astute mapping enabled race teams to generate 485bhp out of the box and, eventually, a reliable 525bhp. Rouse and Soper say period claims of 550bhp-plus were exaggerated, but the car would still top 180mph on the long straights at circuits such as Fuji and Bathurst.

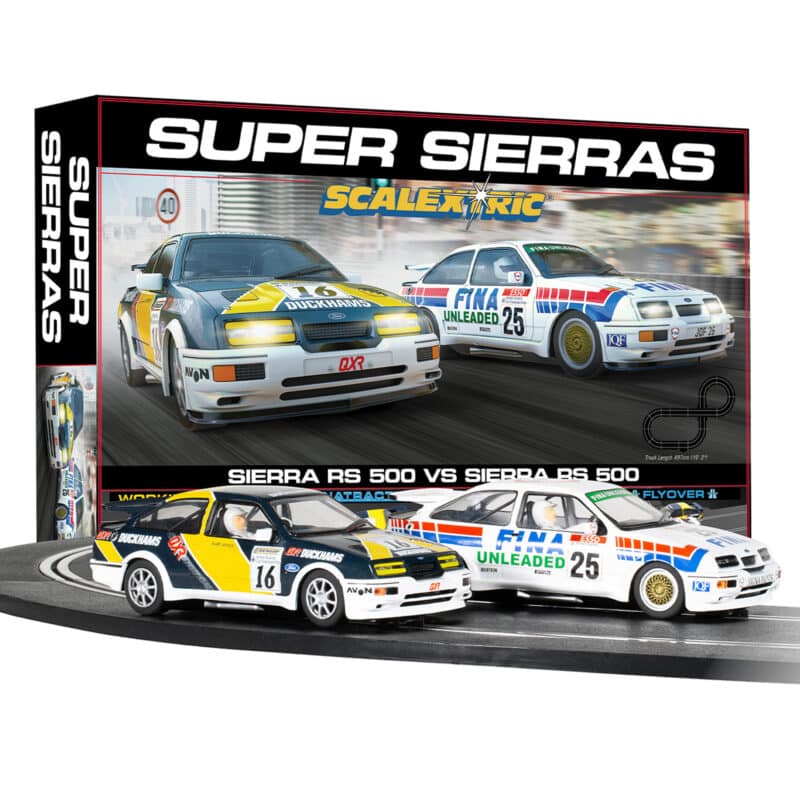

Scalextric Super Sierras Race set

£129.99

Take a nostalgic journey back to the thrilling Group A era of the 1980s with the Scalextric Super Sierra Set. Battle with two Ford Sierra RS500s — complete in old-school livery with working headlights — on a track with multiple layout options and a fly-over bridge.